Presentation of the IBIS® software

The IBIS® Integral Banking Information System software is an ERP that handles all the operations of banks, financial institutions and decentralised financial systems (SFD) as practised in French-speaking African countries. It was designed in 1991 by a team of seasoned IT specialists under the technical guidance of eminent bankers. The result of more than three decades of research and development, IBIS® is now used by some fifty banks and financial institutions. It is made up of over four thousand (4000) tasks grouped into one hundred (100) thematic modules that can be interfaced with all the Core Systems around a dozen centres of interest.

Technical specifications

Programming language

IBIS® is developed mainly in C# under .Net, ensuring a solid foundation and portability between different platforms.

Platform

IBIS® is compatible with a range of operating systems, including Windows, Linux and macOS, offering flexibility of use.

Architecture

IBIS® adopts a modular architecture based on microservices, promoting flexibility and scalability.

Database

IBIS® uses a relational database such as SQL to manage customer data efficiently.

User Interfaces (UI) / User Experience (UX)

The IBIS® user interface is designed to provide an intuitive experience, with user-friendly features and easy navigation.

Interoperability

IBIS® incorporates interoperability standards, making it easy to exchange data with other systems and applications.

Security

IBIS® uses advanced security protocols, including identity management and data encryption, to guarantee the confidentiality of information.

Performances

IBIS® is optimised for high performance, with fast response times and efficient use of system resources.

Maintenance and updates

IBIS® is designed with mechanisms to facilitate maintenance, bug correction and transparent updates for users.

Documentation

IBIS® offers comprehensive documentation, including user guides, technical manuals and developer resources.

Testing and Code Quality

IBIS® undergoes rigorous testing, including unit testing and static analysis of the code to guarantee its quality.

Languages and Localisation

IBIS® supports localisation for multiple languages, offering global adaptability.

Error Management

IBIS® incorporates robust error management, ensuring application stability even under unforeseen conditions.

Compliance

IBIS® has been developed in compliance with banking security and compliance standards, guaranteeing that it can be used in full compliance with regulations.

These technical features demonstrate our commitment to providing a reliable, high-performance software package tailored to the needs of our users.

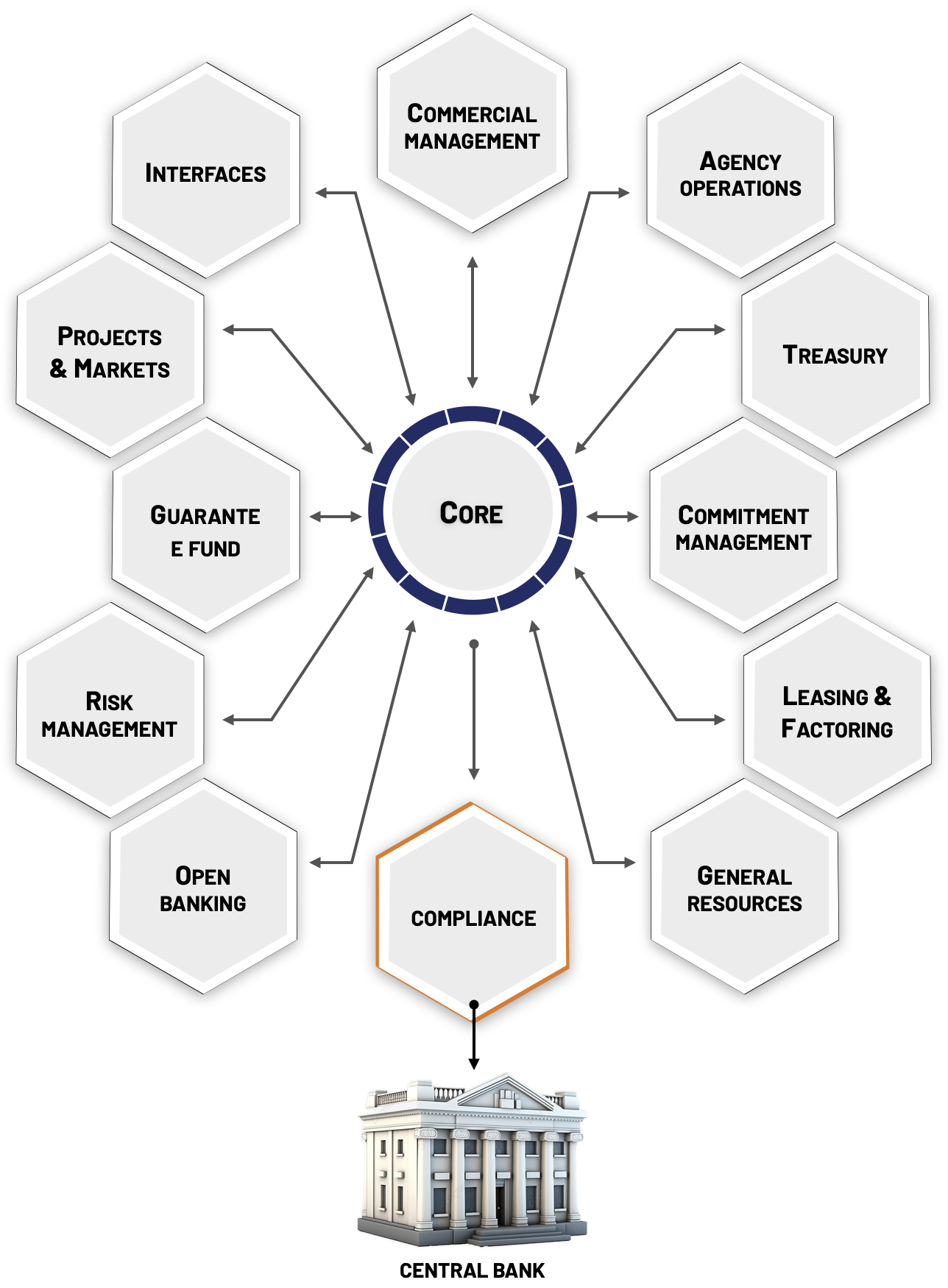

Synoptic view

IBIS® offers a wide range of 13 areas, each carefully designed to meet the specific needs of your institution.

M01. Core

Applications Group, which manages security and the general parameters common to all the software modules in a single place. It also lays the foundations for general and auxiliary accounting.

M02. Commercial management

A group of applications that enable customers to be managed more efficiently, offering them a faster and more accurate service.

M03. Agency operations management

Group of Applications for managing and controlling operations linked to the agency's activity. Depending on your needs, this module can be used as a standard or customised module.

M04. Treasury management

Group of applications essential to end-to-end cash management. It provides real-time reporting and analysis of sensitive operational data.

M05. Customer commitment management

A group of applications used to evaluate on- and off-balance sheet customer commitments, including credit lines, guarantees, securities and other contingent liabilities.

M06. Leasing and factoring

Group of applications enabling financial institutions to manage their customers' leasing and factoring operations.

M07. Guarantee fund

Group of Applications used to manage the execution phases of guarantee funds.

M08. compliance

Applications group producing regulatory reports required by the authorities.

M09. Gestion des moyens généraux

Applications Group for managing the bank as a business.

M10. Open banking

Group of applications and services that enable banks and fintechs to access customer banking data via APIs within a regulatory framework.

M11. Gestion des risques

Group of applications used to assess credit risk.

M12. Projects and markets

Group of applications for the automated management of property projects and contracts.

M13. Interfaces

Interbank exchange management applications group.