Open Banking is a major source of innovation that is poised to reshape the banking sector. It enables consumers to access and control their bank and financial accounts through third-party applications. So financial inclusion is no longer a dream.

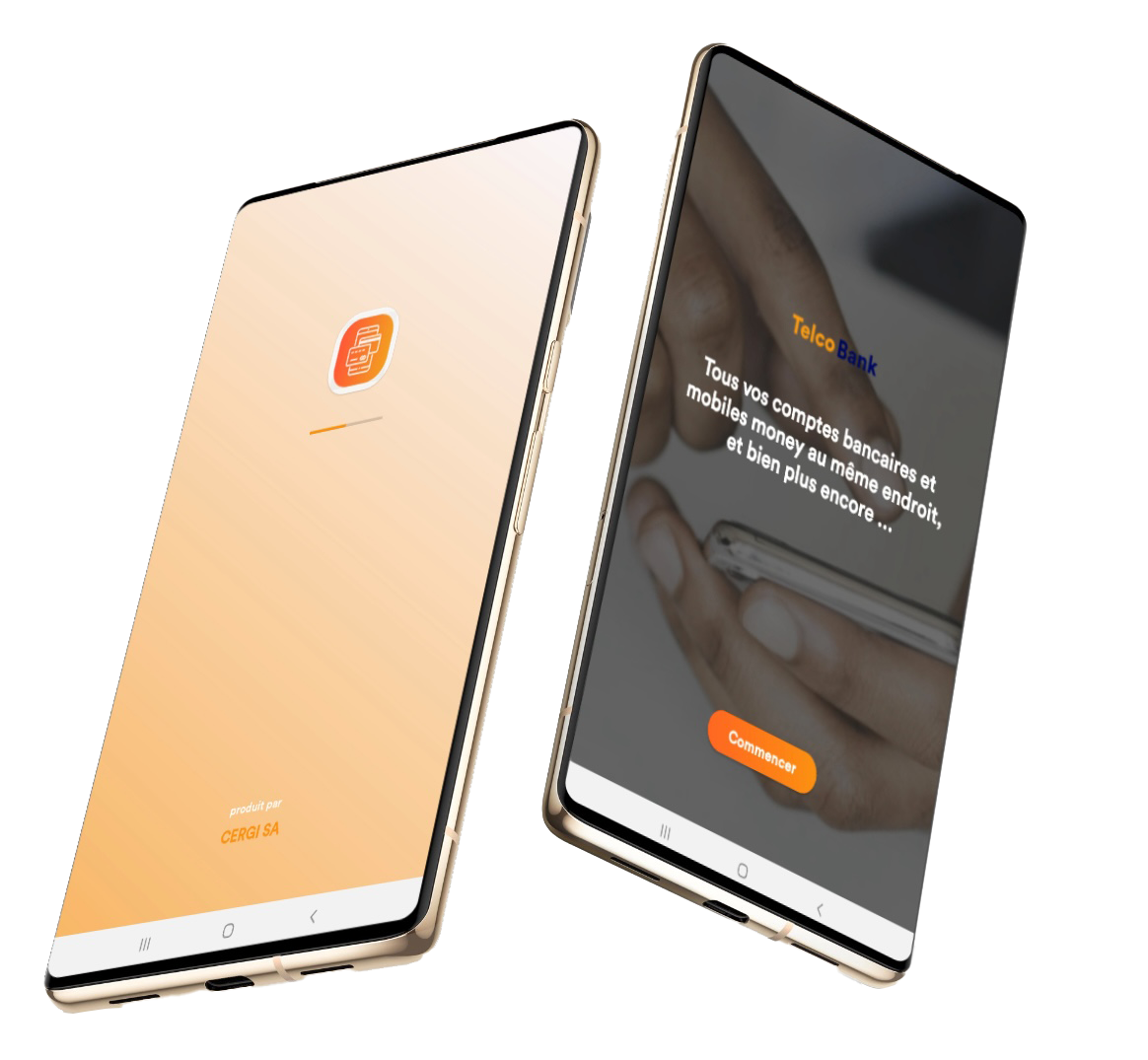

TelcoBank©

TelcoBank enables banks to harness a wealth of data to deliver better digital

digital experiences and increase efficiency.

Banking data is a valuable asset for banks. It can be used to create innovative, personalised

innovative, personalised digital services that enhance the customer experience. TelcoBank provides banks with

banks secure and compliant access to customer banking data.

This gives them the opportunity to offer digital services that are faster, easier to use

and more tailored to customer needs.

TelcoBank can also help banks to simplify their operations. Banking data can be used to automate

be used to automate processes, identify risks and improve decision-making.

This allows banks to reduce costs and improve efficiency.

TelcoBank is a powerful tool that promises to help banks deliver better digital experiences

and increase efficiency.

Managerial Dashboard_BI

A genuine decision-making tool that enables the bank's authorised representatives, when on the move, to monitor sensitive transactions and exercise their decision-making powers in real time, in complete security. sensitive transactions and exercise their decision-making powers in real time and in total SECURITY via internet-connected smartphones or tablets connected to the Internet.

Benefits at every stage of the customer experience

An enhanced customer experience

Customers can access their bank details more easily and more securely. This allows them to manage their personal finances more effectively and access new financial services, such as comparing services, such as comparing loan offers or tracking expenses.

A new range of financial services

TelcoBank enables companies to offer innovative new financial services. These can include instant loans, interest-bearing savings accounts or personal finance management services.

Improved decision-making

Companies can use banking data to make better business decisions. This could include analysing risks, customising products and services or improving the efficiency of operational efficiency.